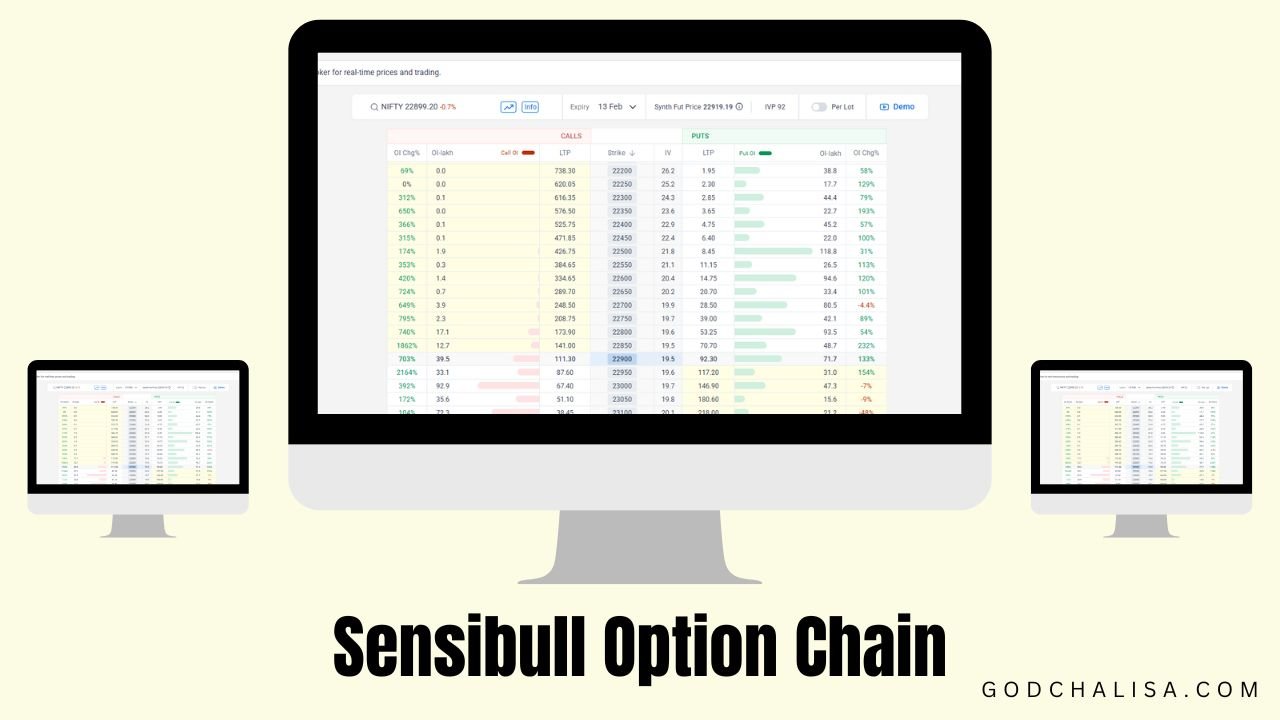

In the world of options trading, understanding the option chain is crucial for making informed decisions. Sensibull Option Chain is a powerful tool that helps traders analyze the market, evaluate trading opportunities, and optimize their strategies. Sensibull, India’s first options trading platform, provides traders with an intuitive interface and in-depth market insights. Whether you are a beginner or an experienced trader, using Sensibull Option Chain can significantly enhance your trading efficiency.

What is Sensibull?

Sensibull is an advanced options trading platform designed to assist traders in making informed decisions by providing real-time market data, strategy building tools, and risk analysis. The platform simplifies options trading by offering easy-to-use features such as strategy builders, virtual trading, and market analytics. Sensibull login allows users to access a suite of tools that help them make strategic trades based on market trends and data insights.

Understanding Option Chain in Sensibull

An option chain is a listing of all available option contracts for a specific stock or index. It includes data such as strike price, expiration date, open interest, and implied volatility. Sensibull’s option chain provides traders with a structured view of all available options contracts, helping them analyze market sentiment and liquidity.

Features of Sensibull Option Chain

- Live Market Data – Real-time updates on options pricing, implied volatility, and market trends.

- Open Interest Analysis – Helps traders identify potential price movements based on market participation.

- Strategy Builder – Allows traders to create and backtest trading strategies.

- FII DII Data Integration – Access to Sensibull FII DII Data, which provides insights into institutional investors’ activities.

- Advanced Filters – Traders can filter by expiry dates, strike prices, and other parameters.

- Greeks Calculation – Essential for options traders to analyze risk and profitability.

- Virtual Trading – Practice trading without financial risk before entering live markets.

Sensibull Login: How to Access the Platform

To utilize the Sensibull Option Chain’s, users need to complete the Sensibull login process. Here’s how you can access the platform:

- Visit Sensibull’s official website.

- Click on the Login button on the homepage.

- Choose your brokerage account to log in. Sensibull integrates with major brokers like Zerodha, Upstox, and Angel One.

- Enter your credentials and complete the authentication process.

- Once logged in, navigate to the Option Chain section to analyze market data.

Benefits of Using Sensibull Option Chain

1. Enhanced Market Analysis

The Sensibull option chain provides real-time data, making it easier for traders to analyze market trends and make informed decisions.

2. Identifying Liquidity and Volatility

The option chain Sensibull tool allows traders to determine which options have the highest liquidity and how volatility is impacting the market.

3. Strategic Trading with Sensibull

Using the strategy builder, traders can create, test, and implement options trading strategies tailored to market conditions.

4. Access to Sensibull FII DII Data

Traders can monitor institutional investor activities using Sensibull FII DII data, helping them align their trades with market movements.

5. Risk Management Tools

Sensibull offers comprehensive risk management features, including stop-loss recommendations and probability analysis.

Table: Sensibull Option Chain vs. Traditional Option Chain

| Feature | Sensibull Option Chain | Traditional Option Chain |

| Real-Time Data | Yes | Limited |

| Strategy Builder | Yes | No |

| Virtual Trading | Yes | No |

| FII/DII Data Integration | Yes | No |

| Greeks Calculation | Yes | Limited |

| Open Interest Analysis | Yes | Basic |

| Broker Integration | Yes (Multiple Brokers) | No |

How to Use Sensibull Option Chain for Trading

- Analyze Open Interest: Use option chain Sensibull to determine the strength of support and resistance levels.

- Monitor Implied Volatility: High volatility suggests larger price swings, while low volatility indicates stability.

- Check FII/DII Data: Institutional investments provide insights into potential market directions.

- Use Strategy Builder: Test different trading strategies before executing live trades.

- Set Alerts: Stay informed about significant market movements by setting custom alerts.

Conclusion

The Sensibull Option Chain is an indispensable tool for traders looking to make informed decisions in the options market. With features like real-time data, Sensibull FII DII data, strategy builders, and seamless Sensibull login, the platform offers a comprehensive solution for both novice and experienced traders. By utilizing the option chain Sensibull, traders can enhance their market analysis, manage risks effectively, and execute profitable trades.

FAQs

Q1. What is Sensibull?

Sensibull is an options trading platform that provides traders with real-time market insights, strategy-building tools, and risk management features.

Q2. How do I access the Sensibull Option Chain‘s?

You can access it by completing the Sensibull login process and navigating to the option chain section on the Sensibull platform.

Q3. Why is the Sensibull Option Chain’s useful?

It helps traders analyze market trends, open interest, volatility, and liquidity to make better trading decisions.

Q4. Can I use Sensibull without a brokerage account?

No, you need a linked brokerage account to use Sensibull’s full features.

Q5. Does Sensibull provide FII DII data?

Yes, Sensibull FII DII data provides insights into institutional trading activity, helping traders make informed decisions.

Read Our More Blogs:-